UCPath is designed to streamline and standardize Human Resources and Payroll Services processes for increased efficiency at the campus level and consistency across other UC campuses.

One item being updated is how employee fringe benefits are assessed to internal, campus-based budgets and sponsored projects (for example, funds awarded externally from agencies such as the National Science Foundation, National Institutes of Health, or U.S. Forest Service). Specifically, the university will transition to a new costing methodology of assessing employee fringe benefits, which is called Composite Benefit Rates (CBRs).

What are Composite Benefit Rates?

CBRs are standard benefit rates developed each fiscal year and used for business transactions containing a fringe benefit component. Our current practice assesses fringe benefits based on hundreds of detailed rates. With the adoption of CBRs, individual employee fringe benefits will be assessed using one of the possible rates below:

*These are proposed rates and subject to change. Due to delays in obtaining CBR rate approval, and per UCOP guidance, the campus will use FY26 proposed rates, which will be updated as applicable when an agreement has been approved/negotiated with our cognizant agency (CAS). The same proposed rates should be used for planning purposes for the outlying years.

*These are proposed rates and subject to change. Due to delays in obtaining CBR rate approval, and per UCOP guidance, the campus will use FY26 proposed rates, which will be updated as applicable when an agreement has been approved/negotiated with our cognizant agency (CAS). The same proposed rates should be used for planning purposes for the outlying years.

How are CBRs Calculated?

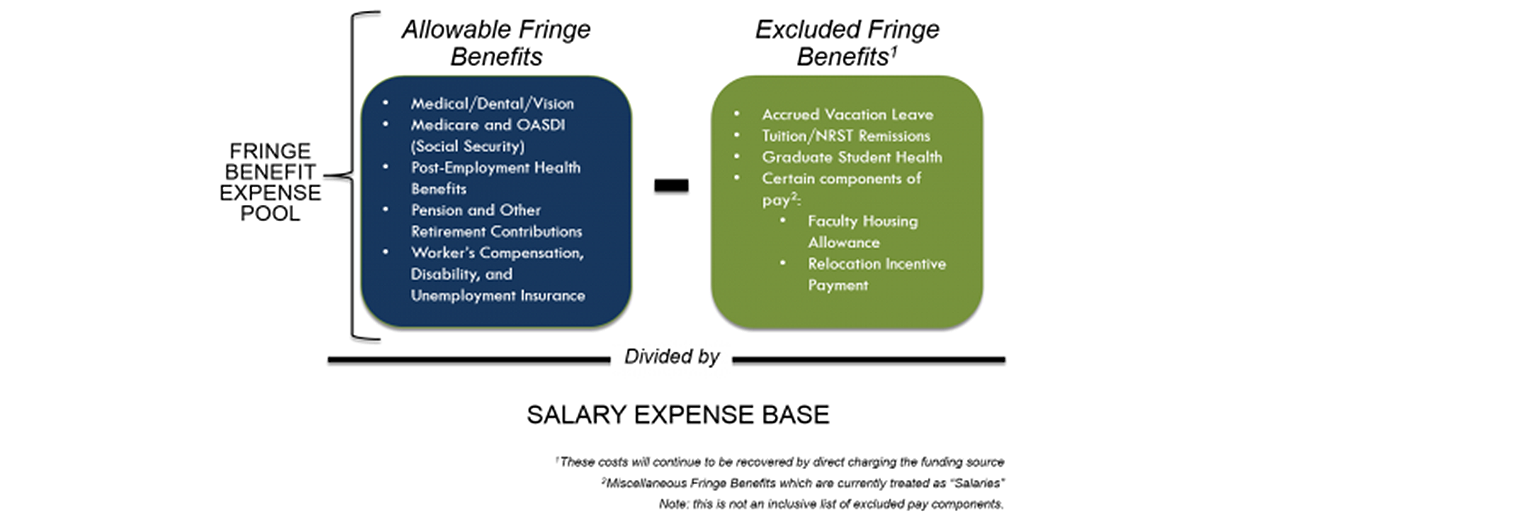

Compared to the current costing method for fringe benefits, the composite method is simplified and is computed using the following calculation model (current and future CBRs are calculated and managed centrally by UCOP and the Costing & Policy Office):

Please note that the fringe benefit costs excluded from the CBR calculation will continue to be recovered by direct charging the applicable funding source. A complete list of these items can be found in the Budget Planning Guide located in the CBR Resources section of this page.

How Do I Know What CBR to Use?

CBRs are assigned to employees by looking at a few different attributes of their current appointment and benefits eligibility. Specifically, it will help in knowing the employee's;

- FLSA (Fair Labor Standards Act) Designation

- BELI (Benefits Eligibility) Status

- Current Title Code

- Earn Code (For Faculty Summer Salaries)

If you need assistance in collecting this information, please contact your Management Services Officer/Business Officer.

The Guide of Title Codes is available to assist in assigning a corresponding CBR Rate, noting that the FLSA and BELI status must be equally considered.

Mapping UCPath Earn Codes to CBR GAEL and Vacation Leave Eligibility

Please use the UCPATH Earn Code Mapping to see which UCPath earn codes are subject to CBR, GAEL or Vacation Leave Assessment.

Mitigation Plan for Sponsored Awards

A mitigation plan to offset increased costs due to CBR implementation to existing sponsored awards is being drafted and reviewed. Details on the mitigation plan will be presented at a later date.